- Locations we service

Medicine Hat motorcycle insurance

Motorcycle insurance in Medicine Hat that’s right for you.

PC® insurance can find coverage for you and your motorcycle in Medicine Hat.

Why is motorcycle insurance important in Medicine Hat?

Why is motorcycle insurance important in Medicine Hat?

Driving a motorcycle can be risky and traffic collisions can result in serious injury.

In the event of an accident, your policy covers personal liability and provides accident benefits.

If you buy collision and comprehensive coverages, theft and damage to your motorcycle may also be covered.

It’s easy to buy motorcycle insurance in Medicine Hat.

1

Have your ownership and driver’s licence ready.

2

Get a quote and finalize your coverage.

Save with PC® Motorcycle Insurance. Get a quote in minutes.

How much is motorcycle insurance in Medicine Hat?

There are several factors taken into account when calculating the cost of your motorcycle insurance.

Factors Impacting Cost

Make and model of your bike

Some motorcycles are more expensive than others to insure.

Where you live

If you live in a dense, urban area with high instances of motorcycle theft, collisions and/or other types of insurance claims, you may pay more than someone living in a rural area.

Your driving experience

A rider’s driving experience has an impact on insurance rates. More experienced riders with a longer history of safe riding will usually pay lower premiums.

How much you ride

The more kilometres you put on your bike, the more likely your insurance cost will rise. Be sure to tell us as much detail as possible about how much you plan to use your bike.

What does motorcycle insurance cover?

What does motorcycle insurance cover?

A basic motorcycle insurance policy includes these coverages:

Liability

Accident Benefits

Uninsured Automobile

Direct Compensation Property Damage

If you also buy Collision and Comprehensive coverages, theft and damage to your motorcycle may be covered.

How can I lower my motorcycle insurance cost in Medicine Hat?

Check out these ways to save on your motorcycle insurance.

Save with PC® Motorcycle Insurance. Get a quote in minutes.

FAQs

Motorcycle insurance is a type of insurance policy that covers a motorcycle and driver.

A basic motorcycle insurance policy includes these coverages:

Liability

Accident Benefits

Direct Compensation Property Damage

Uninsured Automobile

For details about these coverages, see “Why should I get automobile insurance?”

If you also buy Collision and Comprehensive coverages, theft and damage to your motorcycle may be covered.

Get your free online quote now (in Nova Scotia, New Brunswick, and Prince Edward Island) or give us a call at 1-877-253-8177.

Motorcycle insurance can provide coverage for street bikes, cruisers, and touring bikes.

PC® Insurance also covers limited-speed motorcycles, such as scooters, depending on the type.

To find out if your vehicle type is eligible for coverage with PC® Insurance, give us a call at 1-877-253-8177.

The price depends on a number of factors, such as where you live, make and model of your motorcycle, and how often you ride.

Get your free online quote now (in Nova Scotia, New Brunswick and Prince Edward Island) or give us a call at 1-877-253-8177.

Yes! You can earn 2x the regular PC Optimum™ points for every dollar spent when paying your insurance premium annually with your President's Choice® Financial Mastercard®*. You can also earn 2x the regular PC Optimum™ points for every dollar spent when you pay your insurance premium annually with your PC Money™ Account*.

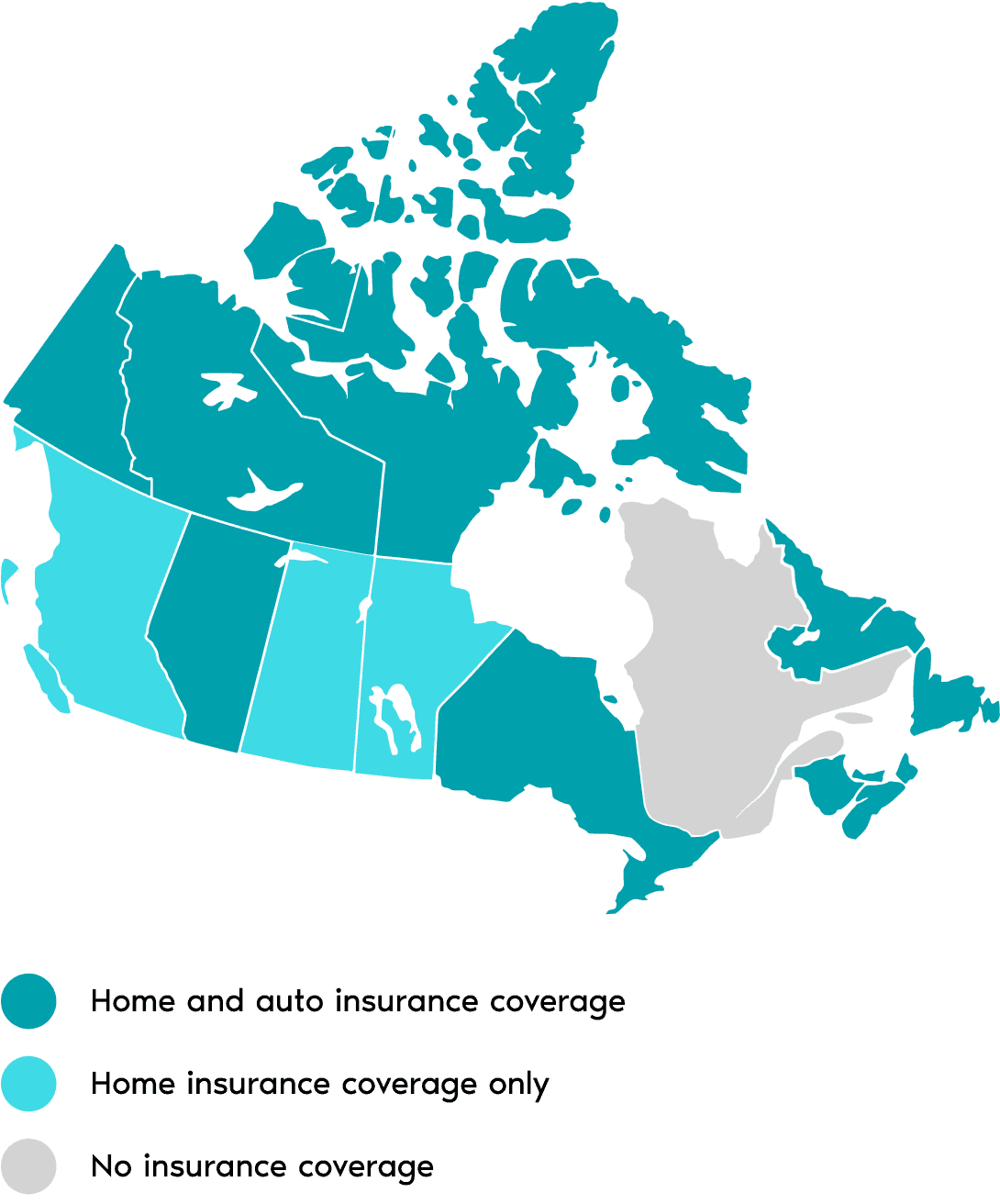

Where we are.

Servicing 12 provinces and territories.

British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Prince Edward Island, Nova Scotia, Newfoundland & Labrador, Yukon, Northwest Territories and Nunavut.

Find your locationLegal details

Important Information on Products, Discounts, and Services by PC Financial Insurance Agency Inc.

Not everyone who uses online platforms or calls in will be able to get a quote or buy an insurance policy. This page provides, for information purposes only, a summary of our different insurance products and discounts that may be available to you. If you purchase a product, the terms and conditions of your insurance coverage will be outlined in your insurance policy, which will prevail. Certain conditions, limitations, and exclusions apply. Savings are not guaranteed and vary based on your profile and place of residence. Rates, discounts, and eligibility rules are subject to change without notice. Please speak to a PC® Insurance agent to learn more.

*All purchases with the PC Financial® Mastercard® earn a minimum of 10 PC Optimum™ points per dollar and all purchases with the PC Money™ Account earn a minimum of 5 PC Optimum™ points per dollar. When you pay your PC® Insurance home or auto insurance premium with your PC Financial® card, earn double the regular PC Optimum™ points per dollar (20 points per dollar for PC Financial® Mastercard® and 10 points per dollar for PC Money™ Account). PC Optimum™ points are awarded exclusively by President’s Choice Services Inc. This is not an offer provided by any other entity. PC Money™ Account points offer is available only with Aviva General Insurance Company policies entered into after January 20, 2025. Minimum redemption is 10,000 PC Optimum™ points (worth $10 in free rewards) and in increments of 10,000 PC Optimum™ points thereafter, at participating stores where President's Choice® products are sold. Some redemption restrictions apply; visit pcoptimum.ca for details and full store list.

ꝉSave up to 35% on PC® Home and Auto Insurance

PC Optimum™ members could save up to 35% on their homeowner’s, condominium, or tenant insurance policy if they are eligible for the following discounts: Claims Free Discount, Combined Policy Discount by purchasing your home and auto insurance together, and Affinity Discount for PC Optimum™ members . In British Columbia, these discounts are not applicable as savings have already been factored into the premium rating calculation or the discounts do not apply. PC Optimum™ members may also save up to 35% on their car insurance policies if they are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount by purchasing your auto and home insurance together, and Affinity Discount for PC Optimum™ members. Customers may be eligible for other discounts on their car or home insurance such as the Electric Vehicle Discount, Hybrid Vehicle Discount, Winter Tire Discount, Mortgage Free Discount and Multi Product Discount. Total available discounts are in comparison to the base premium you would have paid if you were not eligible for the discounts. Discounts may not apply to all coverages and endorsements. PC Optimum™ members must be in good standing to be eligible for the Affinity Discount. Certain conditions, limitations, and exclusions apply. For further information, see More Information section below.

Affinity Discount for PC Optimum™ Members

PC Optimum™ members in good standing could benefit from an Affinity Discount on their homeowner’s, condominium, and tenant insurance in the following provinces: Alberta, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador. Additionally, an Affinity Discount could apply on car insurance for PC Optimum™ Members in the following provinces: Alberta, Ontario, and Nova Scotia.

Save up to 25% on PC® Motorcycle Insurance

You could save up to 25% on your motorcycle insurance when combining the following discounts: Loyalty, Conviction Free, Motorcycle and Car, Motorcycle and Property, and Multi-Motorcycle. Discounts may not apply to all coverages and endorsements. Due to provincial legislation, PC® Insurance motorcycle products are not offered in British Columbia, Manitoba, and Saskatchewan. Savings are not guaranteed and vary based on your profile and place of residence. Rates, discounts, and eligibility rules are subject to change without notice. If you purchase a product, the terms and conditions of your insurance coverage will be outlined in your insurance policy, which will prevail. Certain conditions, limitations, and exclusions apply.

More Information Section

British Columbia

In British Columbia, savings for being claims-free have already been factored into the premium rating calculations for homeowner’s, condominium, and tenant insurance policies.

Alberta

You can save up to 30% on car insurance if you are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members. You could also save up to 20% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Saskatchewan

You can save up 15% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the Claims Free Discount.

Manitoba

You can save up 15% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the Claims Free Discount.

Ontario

You can save up to 30% on car insurance if you are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members. You could also save up to 25% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

New Brunswick

You can save up to 35% on car insurance if you are eligible for the following discounts: Conviction Free Discount and Combined Policy Discount. You could also save up to 40% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Nova Scotia

You can save up to 40% on car insurance if you are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members. You could also save up to 40% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Prince Edward Island

You can save up to 30% on car insurance if you are eligible for the following discounts: Conviction Free Discount and Combined Policy Discount. You could also save up to 40% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Newfoundland and Labrador

You can save up to 30% on car insurance if you are eligible for the following discounts: Conviction Free Discount and Combined Policy Discount. You could also save up to 35% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Northwest Territories, Yukon, and Nunavut

You can save up to 10% on car insurance if you are eligible for the Combined Policy Discount. You could also save up to 30% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount and Combined Policy Discount.